When farmland changes hands, whether through purchase or inheritance, the conversation often centers on soil quality, productivity potential, and purchase price. But there’s another factor that directly affects both the value of the land and the tax implications for the new owner: residual fertility.

Residual fertility refers to the nutrients already present in the soil at the time of purchase, above and beyond what crops need for a normal yield. If properly documented, that excess fertility can qualify for a significant tax deduction. At Advanced Agrilytics, we’ve built a process that not only calculates residual fertility but does so in a way that is accurate, field-specific, and defensible with the Internal Revenue Service (IRS).

In a recent webinar, Rick Riegner, leader of our Grower Direct team, and Dr. Kess Berg, our Chief Innovation Officer, walked through how we approach Residual Fertility Valuation (RFV). Here are the key takeaways.

| “The Science Behind RFV” Webinar is now available on-demand – Watch it here! |

Section 180 and the Role of Residual Fertility

Section 180 of the IRS tax code, introduced in 1960, allows farmers to treat fertility inputs like fertilizer and lime as expenses rather than long-term capital investments. Even though multiple tax codes can apply to fertility-related deductions, Advanced Agrilytics references “Section 180” as a generic term applying to any of those codes.

Why is it important to know about these fertility-related deductions? Because they can have a big impact on your operation’s bottom line.

When you purchase farmland, the IRS assumes part of the premium you paid reflects the fertility already in the soil. As crops are grown, excess fertility is consumed. By documenting it, you can claim a deduction to recover some of that premium over time.

On average, residual fertility deductions range from $500 to $2,000 per acre. That range depends on accurate, defensible calculations, something our data-driven approach is designed to provide.

A Landmark IRS Ruling: Why Accuracy Matters

In 1991, the IRS issued a Private Letter Ruling (PLR 9211007) that highlighted what’s required to claim a residual fertility deduction. The taxpayer in that case was denied their deduction for two reasons:

- They failed to prove which portion of the soil fertility came from the previous owner’s applications.

- They tried to use averages from neighboring farms to establish critical levels, which the IRS rejected due to natural soil variability.

The lesson is clear: residual fertility must be documented with field-specific soil testing and analysis. Regional averages and generic assumptions don’t hold up under IRS scrutiny. At Advanced Agrilytics, that’s exactly why we emphasize unique, field-by-field critical levels.

Beyond Concentration: Why Availability Matters

Soil tests report concentration, which is how much of a nutrient is present in the soil. What soil tests don’t measure is nutrient availability, or how much of any given nutrient is actually available to the crop. For example, phosphorus locked in the wrong soil chemistry may show up on a test but remain unavailable to plants.

This is what makes Advanced Agrilytics, and our approach to Residual Fertility Valuation, so different. We go far beyond a traditional, lab-generated soil test report. For example:

- We standardize data from different labs (which may report in different units or use different extractants) and convert it into a consistent format.

- We convert all measurement outputs into a standard unit (pounds per acre) so it can be accurately measured and valued.

- Then, we apply agronomic logic to determine both availability and excess fertility.

This distinction is vital for creating a valuation that truly reflects what’s in the soil and what the IRS will accept as defensible.

Critical Levels: The Science Behind “Enough is Enough”

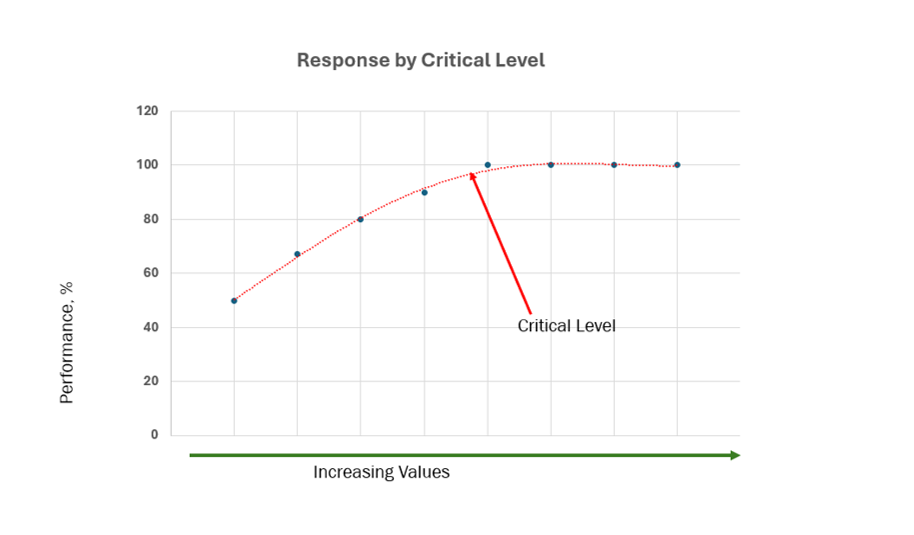

A critical level is the soil test value at which adding more of a nutrient no longer improves yield. Think of it as the “enough is enough” point on a crop response curve.

This chart shows the “critical level”, or the soil test level at which a higher rate of a given nutrient no longer improves yield performance. This is demonstrated by the point at which the performance curve flattens out.

Establishing Critical Levels the Advanced Agrilytics Way

Many states publish critical levels for nutrients like phosphorus and potassium, but we know that’s only the starting point. Nutrient availability on any given acre is also influenced by the soil’s chemistry and environment, including:

- Charge density: Calcium, with a +2 charge, binds more tightly to soil particles than potassium with a +1 charge, which changes how much of each is actually available.

- Cation Exchange Capacity (CEC): The soil’s ability to hold and exchange nutrients, which directly affects how much fertility is usable by the crop.

- Soil pH: A driver of nutrient availability, especially micronutrients such as iron, zinc, and manganese, but also influential on phosphorus and other macronutrients.

Where Advanced Agrilytics is different is in how we bring all of this together.

Using our TerraFraming® platform, we apply proprietary algorithms to go beyond state thresholds and generic soil tests. For example, in the webinar, Dr. Berg showed how we calculate Organic Matter Contribution, which calculates how nitrogen and sulfur mineralize from organic matter under specific field conditions. This allows us to factor in not just the percentage of organic matter, but also how temperature, moisture, and topography influence its contribution.

By combining state guidelines with our field-level modeling inside TerraFraming, we establish critical levels that are unique to each field. That makes our calculations of excess fertility, and the dollar values tied to them, more accurate and more defensible than approaches that rely on averages or generalized lab data.

What Landowners Receive

At the end of the process, each landowner receives a consolidated PDF report that contains:

- One report per field or combined if multiple fields are involved.

- Soil test results from certified labs.

- Critical levels and excess nutrient calculations.

- Documentation of the methodology behind the analysis.

This isn’t just a lab printout. It’s a comprehensive, IRS-defensible report that justifies the residual fertility deduction claimed in a tax filing. It’s an invaluable tool your CPA can use to confidently document and defend that deduction in the event of an IRS audit.

What Sets Advanced Agrilytics Apart

Several factors make Advanced Agrilytics unique in this space:

- Agronomy-first expertise. Our Residual Fertility Valuation Program is built on the same science, technology, and expertise we use to drive predictive agronomic decisions for growers every day.

- Field-specific critical levels. We calculate nutrient thresholds unique to each field, ensuring accuracy and defensibility.

- Independent, third-party fertilizer pricing. Instead of phoning ag retailers to get fertilizer prices, we’ve partnered with a global market research firm to maintain a 10-year, month-by-month nutrient pricing database (including FOB to the U.S. costs). This ensures consistent, defendable valuations from a credible third-party source.

- Added grower value. Along with RFV reports, we can provide variable rate recommendations for lime, phosphorus, and potassium. This gives growers a preview of our broader agronomic approach while delivering immediate, added value to their Residual Fertility Valuation report.

Why It Matters

Residual Fertility Valuation is more than a tax strategy. It’s a way to capture the real value of what’s already in your soil. That can mean meaningful tax savings while ensuring you’re on solid ground with the IRS.

At Advanced Agrilytics, our approach combines agronomic expertise, field-specific science, and independent pricing data to deliver reports that are both accurate and defendable. It’s one more way we’re helping growers unlock the hidden value in their acres, today and for years to come.

Want to learn more? Contact us here.

Disclaimer: Advanced Agrilytics does not provide legal, tax, or accounting advice. The information in this article is for general informational purposes only and should not be relied upon as a substitute for professional guidance. We are not certified public accountants (CPAs), attorneys, or tax advisors. Eligibility for IRS Section 180 deductions depends on individual circumstances and is subject to interpretation and approval by the Internal Revenue Service. We do not guarantee results or acceptance of any tax filing or deduction claim. Please consult an experienced agriculture tax professional to determine how this information may apply to your specific situation.

© 2025 Advanced Agrilytics Holdings, LLC. All rights reserved. Advanced Agrilytics and TerraFraming are trademarks of Advanced Agrilytics Holdings, LLC.