Growers considering corn-on-corn acres in 2026 face unique agronomic and economic challenges. This article explores the key considerations—residue, nutrient management, and market outlook—to help make informed decisions for next season.

Editor’s Note: Recently, Advanced Agrilytics hosted a webinar on Maximizing Nutrient Efficiency Amid Rising Input Costs. This blog article is the third in a series drawn from that discussion. It focuses on the various factors that growers should think about now, if they are considering planting corn-on-corn acres in 2026. This article features insights from Advanced Agrilytics’ Chief Innovation Officer, Dr. Kess Berg.

During our recent webinar on Maximizing Nutrient Efficiency Amid Rising Input Costs, Dr. Kess Berg raised an important question many growers are wrestling with: Should you plant more corn-on-corn acres next year?

With input costs high, margins thin, and markets unpredictable, the decision to go back-to-back with corn carries significant agronomic and economic implications. Kess cautioned against waiting until spring to make that call.

“Too many times we try to make that decision in the March timeframe, and that’s too late,” Kess explained. “If you haven’t done anything with that residue or managed that specific ground before next spring, that’s problematic. If you think you might be planting corn-on-corn, make sure you address it this fall, or it’s going to be a hard road in the spring and a costly road where you’re not very effective with some of your nitrogen.”

So, what exactly should growers consider before committing acres to continuous corn? Let’s break it down into key areas: residue management, nutrient management, and market considerations.

| Did you miss the first two articles in this series? Catch up on them now: Maximizing Fertilizer Efficiency Amid Rising Input Costs Maximizing Nitrogen Efficiency in a Tough Farm Economy |

Residue Management: Don’t Leave It Until Spring

Residue is the single most visible challenge when going corn-on-corn. Compared to soybeans, corn leaves behind a heavy load of stalks, cobs, and husks that can tie up nutrients and create planting headaches if not managed ahead of time.

Why residue matters in corn-on-corn:

- Nitrogen tie-up: As residue decomposes, microbes immobilize nitrogen. Without a plan to offset this, early-season N deficiencies can stunt growth.

- Cold, wet soils: Heavy residue insulates the soil, slowing spring warm-up and drying—hindering emergence and root development.

- Planting interference: Thick residue can affect seed-to-soil contact and uniform emergence.

Best practices for managing corn residue:

- Fall tillage: Strategic tillage in the fall can size and incorporate residue, promoting breakdown over winter. Avoid aggressive passes that worsen compaction.

- Residue sizing: Even distribution and sizing at harvest, via combine residue managers, reduces heavy mats and speeds decomposition.

- Biologicals or residue treatments (where practical): These products can accelerate breakdown, though results vary by environment.

- Hybrid selection: Some hybrids leave tougher stalks than others. If you know a field is destined for corn-on-corn, hybrid choice can help manage residue load.

The bottom line: addressing residue in the fall sets the stage for better nitrogen efficiency, soil conditions, and emergence the following spring.

Nutrient Management: Corn-on-Corn Isn’t Soy-on-Corn

Nutrient needs shift substantially when corn follows corn. Unlike soybeans, which contribute some nitrogen back to the soil, corn is a heavy nutrient remover.

Nitrogen considerations:

- Higher total requirement: Corn-on-corn typically demands ~40–60 more pounds of nitrogen per acre than corn after soybeans, according to statistics from Iowa State University, Purdue University, the University of Illinois Urbana-Champaign and the University of Minnesota.

- Timing is critical: Because residue immobilizes nitrogen early, starter N and split applications become more important. Placing some N at or near planting helps the crop get through that early tie-up window.

- Stabilizers: With higher N rates and more passes, stabilizers may play a bigger role in protecting nitrogen against loss.

Phosphorus and Potassium:

- Don’t overlook P & K: Both are essential for early root growth and nutrient movement within the plant. In fields where these nutrients are already marginal, back-to-back corn can quickly expose deficiencies and negatively impact early plant development.

- Starter placement: In low-testing soils, in-furrow or 2×2 starter applications ensure phosphorus is immediately available in cold, residue-heavy soils.

Sulfur:

- Growing importance: With reduced sulfur deposition from the atmosphere, deficiencies are becoming more common. Corn-on-corn acres with heavy residue are especially at risk, since sulfur is both leachable and can be tied up during residue breakdown.

Advanced tools like TerraFraming™ can help by mapping organic matter contribution and nitrogen loss potential at the sub-acre level. This allows Advanced Agrilytics’ agronomists to develop predictive, precise nutrient management strategies that reallocate nutrient applications to where they will provide the best ROI while minimizing nutrient waste.

Market and Marketing Considerations

Of course, agronomy is only part of the decision. Economics may ultimately drive whether a corn-on-corn decision makes financial sense.

Watch the markets closely:

- USDA WASDE reports continue to forecast ample corn supplies, which has kept prices under pressure. But analysts argue those forecasts may underestimate late-season disease and drought stress. If USDA lowers yield or supply in coming reports, price support could firm up.

- Global demand: Softer export demand has capped rallies in recent years. Keep an eye on trade flows, especially China, Mexico, and ethanol demand trends.

Run the numbers:

- Budget scenarios: Model both yield potential and input costs for corn-on-corn vs. corn-soybean rotation. Even a small yield drag in corn-on-corn can erode profitability unless prices improve.

- Risk management: Consider crop insurance options, forward contracts, or hedging tools to protect against downside in the corn market.

The takeaway: market signals can change quickly but waiting until March to make acreage decisions is risky. If there’s even a chance you’ll plant corn-on-corn, get the groundwork done this fall so you aren’t boxed in later.

Don’t Roll the Dice on Spring Fertilizer Prices

It’s a gamble to hold off on fertilizer purchases in hopes that spring prices will be lower than fall. Here’s why:

- The odds are against you, historically speaking: Seasonally, fertilizer demand spikes ahead of planting, and that demand pull often drives prices higher in February and March compared to the prior fall.

- Risk factors pile up in winter: Natural gas volatility, weather-related shipping constraints, and possible export restrictions can all drive prices up unexpectedly.

- Dealer logistics: Retailers typically secure supply in the fall. If you wait until spring, you may not only pay more; you could face limited availability or delayed delivery.

Cash-flow vs. price risk tradeoff: Holding cash by delaying fertilizer buys saves working capital in the fall but exposes you to potential spring premiums.

Real-World Example: UAN & DAP Price Moves

- In March 2025, UAN32 jumped ~6% compared to February: from about $397/ton to $423/ton, per DTN’s retail price tracking.1

- Over spring 2025, nitrogen fertilizer products (urea, UAN28, UAN32) led the price rises across the major fertilizers.1

- On the phosphorus side, DAP showed upward momentum in Q1 2025, driven by seasonal restocking, supply constraints, and trade pressures.2

- More broadly, between spring and fall, spot DAP export prices in the U.S. Gulf rose from ~$625/ton in late 2024 toward $767/ton in mid-2025.3

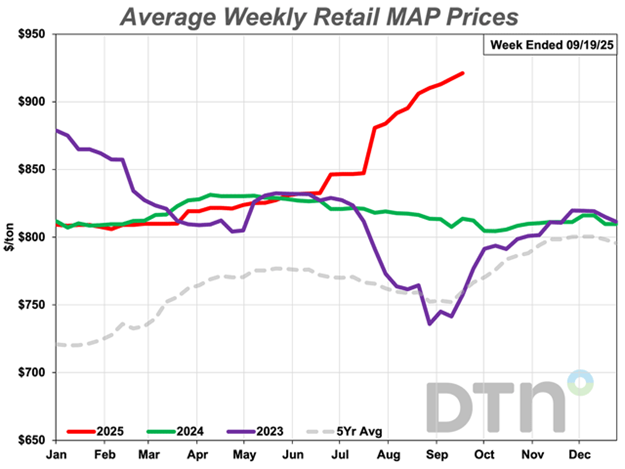

As this chart from DTN shows, MAP prices averaged $921 per ton in September 2025, while DAP averaged $904. Both phosphorus fertilizers have shown steady increases, adding to the higher nutrient costs growers must weigh when considering corn-on-corn acres. According to DTN staff reporter Russ Quinn, the week ending on 9/19/2025 is also the most recent time that both DAP and MAP prices were more than $900/ton at the same time. (Chart credit: DTN/Progressive Farmer, published 09/24/2025.)

As Kess reminded webinar attendees recently, planning ahead doesn’t just protect yield potential, it protects margins in a market where every bushel and every pound of nitrogen counts.

Ready to learn more about working with Advanced Agrilytics? Contact us here.

Sources:

1 DTN Agricultural Retailer Fertilizer Pricing. Accessed September 30, 2025.

2 Chemanalyst.com website. Accessed September 30, 2025.

3 YCharts’ U.S. DAP Export Spot Price Series (U.S. Gulf). Accessed September 30, 2025.

© 2025 Advanced Agrilytics Holdings, LLC. All rights reserved. Advanced Agrilytics and TerraFraming are trademarks of Advanced Agrilytics Holdings, LLC.