Have you recently purchased or inherited farmland? If so, you may also be able to deduct the value of existing excess nutrients already in your soil (called residual fertility). This deduction can lower your taxable income and improve your return on investment in the land.

Advanced Agrilytics’ Residual Fertility Valuation Program helps landowners calculate the value of the opportunity with confidence and precision.

The Residual Fertility Valuation Program is designed to help growers assess and document the fertility status of newly acquired farmland. Through a comprehensive analysis and creation of a Residual Fertility Valuation Report, growers receive a geospatially informed summary of current soil macro- and micronutrient levels to support deduction. The report transforms your soil fertility data into a financial asset, documenting and validating the value of residual soil fertility.

In this article, we’ll explore what Section 180 entails, what’s included in the Residual Fertility Valuation Report, and what landowners should know to determine whether they might benefit.

Please note: “Section 180” has become a catch-all branded term, similar to the way we use “Kleenex” as a generic name for facial tissue. While your accountant may apply a different IRS code depending upon your specific situation, the core concept remains the same: deducting fertility inputs or the residual nutrient value of newly acquired farmland. At Advanced Agrilytics, we collectively refer to all residual fertility-based tax deductions as “Section 180.”

“With an extensive history of soil analysis and fertility expertise coupled with groundbreaking technology, Advanced Agrilytics is uniquely qualified to create and offer this new tool for landowners,” explains Rick Reigner, Executive Vice President of Grower Direct with Advanced Agrilytics. “What we have created is a science-based, defensible process to value the residual fertility at the time of land acquisition. The report provides growers with the data set needed to pursue a residual fertility deduction with their tax advisor.”

The Residual Fertility Valuation Report is engineered by Advanced Agrilytics’ Data Science Team and created using TerraFraming™, our proprietary spatial agronomy intelligence platform. The technologies and processes utilized are the result of Advanced Agrilytics investing more than $25 million in research and development, including sixteen proprietary patents (and four more are pending). In addition, the Advanced Agrilytics team boasts more than 150 years of combined soil science experience, offering unmatched precision and credibility.

What Is Section 180?

Section 180 of the Internal Revenue Code allows qualified landowners engaged in farming to deduct the cost of fertilizer, lime, and other materials used to enrich or condition land used for farming. It may also allow landowners of newly acquired land to treat the residual fertility (pre-existing nutrients) as a deductible cost.

Who Qualifies for a Section 180 Deduction?

Section 180 requirements include:

- Owning agricultural land with a sufficient tax basis

- Actively farming or ranching with the intent to make a profit

- Regularly engaging in activities such as planting, harvesting and/or livestock management

- Properly supporting documentation to support the deduction

Importantly, the IRS has not precisely defined what constitutes “newly acquired” land. However, the general guidance is that the closer the activity is to the time of land purchase, the stronger the case for deductibility. Many CPAs view land purchased within the last three to five years as a potential candidate, though the exact time window will depend on the facts and circumstances of each case. Landowners should consult with their tax advisors to determine eligibility.

What Factors Make Someone More Likely to Qualify for a Section 180 Deduction?

Qualifying for Section 180 deductions is nuanced, but you may be more likely to qualify if:

- Your property is greater than 10 acres

- You have a net passive income of more than $50,000 annually

- You can fully utilize the deduction within the timeframe

Consult with your CPA or tax advisor to confirm eligibility.

Why Is a Residual Fertility Valuation Report Important?

To substantiate a Section 180 deduction, it’s critical to document the fertility status of the land at the time of acquisition. This is where Advanced Agrilytics’ Residual Fertility Valuation Report is a tremendous help to you and your CPA when filing for the deduction.

What’s Included in the Report?

Each Residual Fertility Valuation Report includes:

- Nutrient Inventory: Soil-based valuation of residual macro- and micronutrients, including P, K, N, Ca, Mg, S, Zn, B, Fe, Mn, Cu, Lime

- Valuation Summary: Total dollar value of excess nutrients in the soil

- Geospatial Layers: Field maps of nutrient concentration and variability

- Fertility Recommendations: Input optimization recommendations for next year’s planning

- Compliance Support: Defensible methodology that meets current IRS guidance

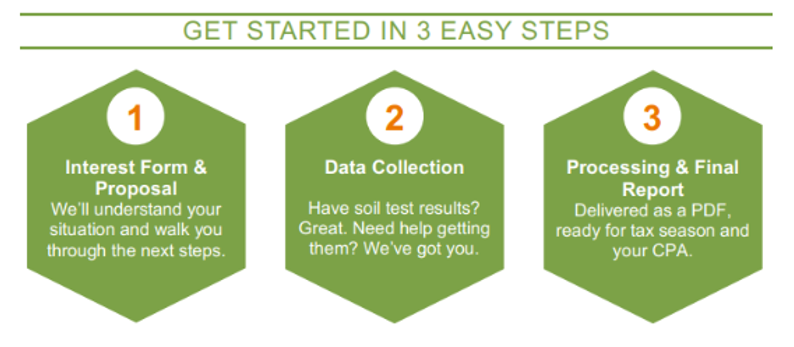

How Do I Get Started?

Note: No new sampling is required if soil data is current and complete. We will take care of formatting and audit readiness.

A Final Note: Consult Your Tax Advisor

Advanced Agrilytics does not provide legal, tax, or accounting advice, and we are not involved in filing your tax return or determining eligibility for IRS Section 180 or other tax deductions. We are not CPAs or tax advisors.

Our role is to:

- Provide a third-party verified Residual Fertility Valuation Report.

- Deliver agronomic documentation that supports the nutrient value of your soil.

- Prepare reports using a defensible, consistent methodology aligned with current IRS guidance.

We do not:

- Prepare or file tax returns.

- Determine your eligibility for Section 180 or any other deduction.

- Represent you in front of the IRS during audits.

We understand that some CPAs or tax advisors are unfamiliar with Section 180 deductions. If you have questions, we can connect you with agricultural accounting experts who specialize in Section 180 and who are familiar with this tax strategy.

Important: All tax-related decisions should be made in consultation with your CPA or tax advisor. We work in partnership with you and your financial team to provide the agronomic documentation needed to evaluate and support your tax claim.

© 2025 Advanced Agrilytics Holdings, LLC. All rights reserved. Advanced Agrilytics and TerraFraming are trademarks of Advanced Agrilytics Holdings, LLC.